“People will do whatever they can to find a world in which they can predict the outcomes of their actions and the consequences of those outcomes”, Howard Stevenson wrote in a Harvard Business Review essay of 1995.

A profound observation I must say. And over the years our quest for predictability has only increased. We believe since we have more data about the past we should be able to predict the future. We believe since we have access to more information, we should be able to predict the future.

The quest to predict the future is honourable and we shouldn’t give it up. In fact, it makes risk-taking and wealth building easier. Which is the purpose of this article.

The first place to look at when we are discussing this quest for predictability is the stock market. The easier it is for investors to predict the revenue and profit of a company the higher the value accorded to such companies.

That’s why companies with a recurring revenue business model get the attention and money of investors more than any other company. Those companies grow wealth for their investors quickly as well.

A predictable outcome makes wealth building easier. Risk is easier to take and reasonable bets can be placed about the future when we have an idea of what we can expect.

In Nigeria, we have been deprived of this ability since I can recollect.

Sometimes in 2008, I was walking down the street with my mama, out of a thirst for predictability, she said “I wished I had some money now so I can buy some shares (of Nigeria banks) for you and your sister so that many years from now when it would have increased in value, you will have something to start life with.” A profound thought from a woman who knows nothing about the stock market but just that money invested in it can increase in value over the years.

Her ability to predict what the future would be was motivation enough for her to take a bet on the future. Also, it was enough for her to make a sacrifice today that will benefit her and us, her children in the future. She could tell with reasonable assurance that the shares she wanted to buy will increase in value.

Before 2019/2020, the truth is that Nigerians haven’t had the privilege of predictability handed over to them. Even if my mama had invested in those shares in 2008 when she made that remark, there is a high likelihood that neither us, the children nor her would benefit from that optimism. For a couple of reasons.

First, 2008 was the middle of the financial crisis and I guess that’s why she got to know about the opportunity to buy shares of banks. Not a lot of those banks have recovered and not a lot are doing great. Below is the Banking Index performance of the Nigeria stock exchange since then. Not much has happened in 13 years to make wealth for the investors. You will agree with me.

Compare that with the same period for the S&P 500, the measure of aggregate wealth creation via the stock market in the US. You see a clear dip and eventual recovery. Not just recovery but also growth.

So our stock market hasn’t made predictability easier. And oh, don’t talk to me about the dividends that would have been paid by those banks or any other. The history of dividend payments in Nigeria only started to get better with reforms from a recent time. Nigerians used to find it extremely hard to recover their dividend.

The second reason is the instability in the exchange rate plus continuous devaluation of our local currency, Naira. In 2008, you only needed about N115 to buy $1. Today, you will need N480 to buy the same dollar. A more than 3x devaluation. That is, over the last 13 years, Naira has lost its value against the Dollar 3 times. That’s wild, compare that to the return one would have made by investing in Nigeria stock and you will see the gory image. No wealth of any significance has been created. Just wealth erosion and inflation-induced growth.

Government bonds didn’t help within this period either.

Well, within the past years, wealth building has left the dining table conversations of Nigerian families. What’s left is survival talks plus thrift contributions and a lot of debt that’s accumulating with no hope of income to furnish the repayment. Little wonder my generation talks a lot about the black tax.

When the future is predictable, humans tend to make decisions that will benefit them in the future. They are ready to make sacrifices today with the expectation of a potential upside in the future. That’s what we learn from my mama’s story and that of many others and the stock market reaction to a host of companies with business models that make their earnings easily predictable.

Otherwise, humans won’t even give a thought to the future beyond tomorrow. After the event between my mama and me that day, we didn’t have a conversation about things like buying shares anymore.

This experience is contrary to what is obtainable in the US, for example.

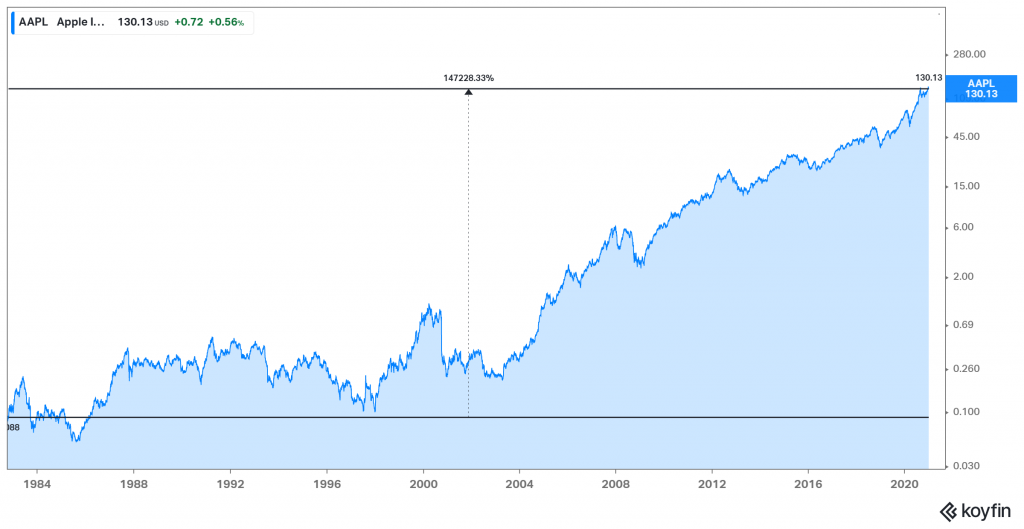

Before 2019, I read a lot of personal finance and investing books written by US authors. One thing that’s common among all books is the constant assumption that you could invest and reliably without any hassle make 10% ROI on an average for as long as you want to invest. This “as long” typically starts from 15 years and ends at 35 years term, it could be more. The people’s ability to reliably predict such a future gave them the motivation to sacrifice a portion of their income today to build wealth for the future. Otherwise, there’s no point.

The result of such a predictable outcome is not far-fetched. More than half of American households have an investment in the stock market.

The new renaissance

To express the gratitude I have right now, I will start by saying, God bless the innovators of this generation. They are incredibly brave, forward-thinking, and down to earth. These innovators will change a lot of things. They will bring back wealth conversation to the dining table and many generations starting from that of mine will benefit from what they are building. Already we do all these on Twitter. It’s no longer conversation as usual.

Alright, David enough of prayers and adulation. Lol.

The new renaissance is being led by companies like Risevest, InvestBamboo, Trove, and Chaka. They are at the forefront of this. What they bring to us is predictability. The single item that motivates us to build wealth.

With their products, they have made predictability easier by eliminating the devaluation and inflation risk and they also expose us to assets that are growing at a predictable estimate.

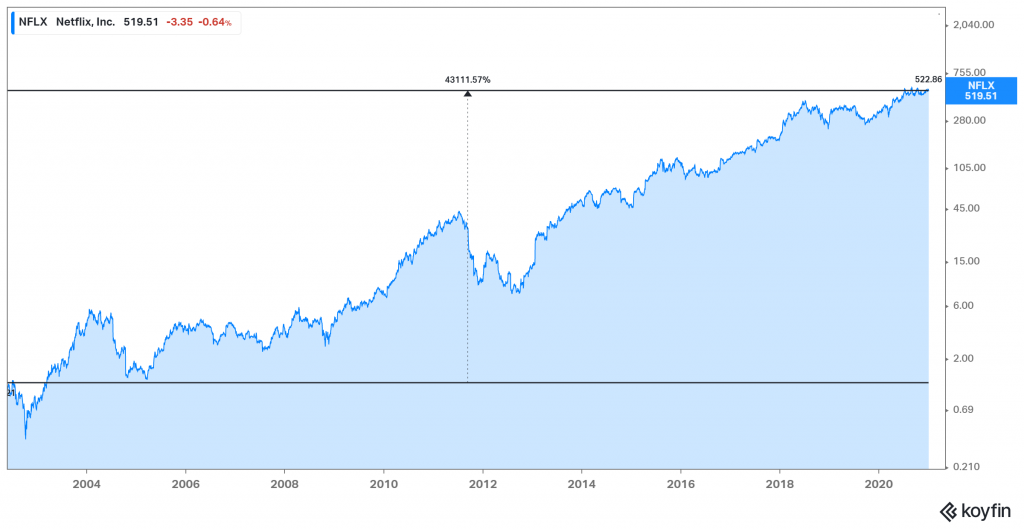

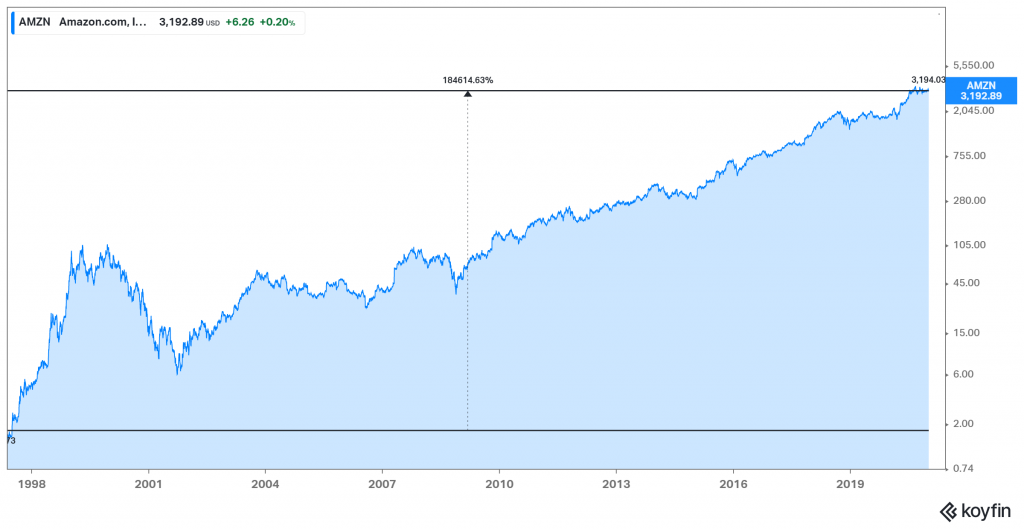

Together, they give us a form of exposure or the other to the US stock market. A market where you can reliably estimate what the future will look like. It’s market share where you don’t need to be a fortune teller to be able to tell that the future is that of growth and wealth creation. In fact, you can reliably put a measure of growth at 10% per annum and you won’t be too far from the truth.

You have no excuse anymore now. You must build wealth. I am not giving you the option not to build wealth. It’s a must.

The only excuse that is tenable is the lack of knowledge. And that’s why I work day and night to bring you articles on this blog. Make this blog one of those that you visit daily. Read the latest articles, and read past articles as well. Also, subscribe to my newsletter where I will bring you some of the contents that you may have missed. You have no excuse again afterward.

You can also book a session with me if you require one to plan your financial life and build wealth. You are a privileged generation. If my mama was able to invest even $1,000 for me in 2008, which would have cost her N115k, that amount would be more than $3,000 now or N1.4M. You have the advantage today. Utilize it. Okay, let me beg you, please, utilize it.