My friends and I, all with nearly a decade of work experience, have been discussing whether to deepen our commitment to a specific industry (even while doing different roles) or to maintain flexibility by moving across industries (even while doing the same type of work).

Most of us started our careers in consulting, which gave us early exposure to more than one industry. We are now thinking about which levers matter most for accelerating our careers over the next decade and beyond.

Our intuition is that committing to an industry would prove more rewarding, both financially and along other dimensions. This view is shaped by observation and anecdotal evidence.

As with most intuitions of this kind, I expected research to exist on the topic, and I found some. In particular, Daniel Parent’s 2000 study, “Industry-Specific Human Capital and the Wage Profile,” addresses this question directly.

Before getting into the details, the conclusion is clear and aligns with our intuition.

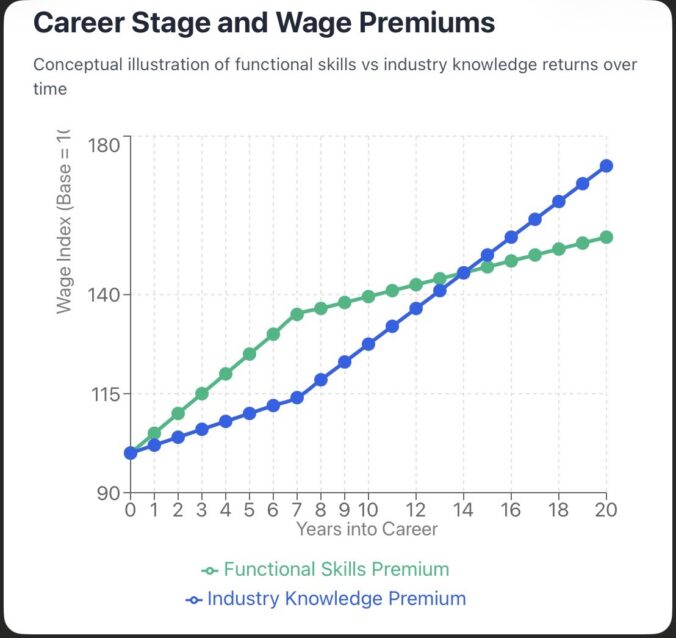

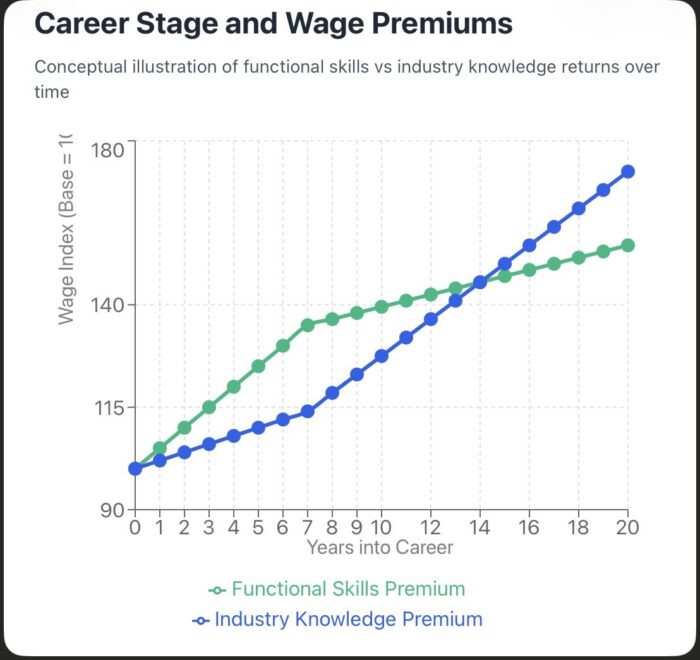

As you progress along the career curve and move out of the early stage (roughly the first 0 to 7 years) into the mid stage from around year 8 onwards, the premium placed on industry knowledge becomes increasingly visible and economically meaningful.

Your functional skills, the ability to perform tasks such as auditing or data analysis, have reach a point where they are assumed and expected. As a result, they command a lower premium than the context in which those skills are applied, such as auditing in banking or data analysis in healthcare.

The Research: Daniel Parent’s study

Parent tracked the same workers (imagine this was tracking my friends and I) over multiple years using data from the National Longitudinal Survey of Youth and the Panel Study of Income Dynamics, examining how their wages evolved based on their employment patterns.

Parent’s key methodological innovation was that he separated three types of experience:

- General labour market experience (total time working)

- Firm tenure (time with your current employer)

- Industry experience (total time in your current industry, potentially across multiple employers)

Previous research, particularly Robert Topel’s influential 1991 work, had found that staying with one employer for 10 years generated roughly 25% higher wages. Topel attributed this to firm-specific human capital—valuable skills and relationships that don’t transfer when you change employers.

Parent suspected this conclusion was wrong. When workers stay at one firm for years, they’re often simultaneously accumulating experience in the same industry. The previous literature couldn’t separate firm effects from industry effects. So it was not clear if the 25% higher wages that Topel found were due to industry or firm experience.

By including all three experience measures simultaneously in his wage equations, Parent could isolate what portion of wage growth comes from firm loyalty versus industry commitment.

His findings were striking.

Once industry experience was properly controlled for, the wage premium for staying with the same employer essentially vanished (Ouch!). Using instrumental variables to account for worker quality, the return to firm tenure disappeared entirely.

What actually drove wage growth was industry experience. Workers who accumulated years in an industry saw substantial wage increases, and these returns persisted even when they changed employers within that industry.

Why Industry Knowledge Commands a Premium

Parent’s research reveals that industry-specific capital accumulates in ways that occupation-specific skills do not. Several mechanisms likely drive this:

- Network effects and reputation: A decade in an industry builds relationships, credibility, and access to opportunities that reset when you move industries, even if you’re doing the same type of work.

- Industry-specific judgement: Knowing which metrics actually matter in healthcare versus fintech, or understanding which regulatory changes are substantive versus performative, takes years to develop and commands premium compensation.

- Closed senior pathways: Many industries have relatively closed leadership tracks. Advancement to senior roles often requires demonstrated industry commitment, as decision-makers value deep sector knowledge. You can probably sense why my friends and I are thinking seriously about this now – we are thinking about that pathway.

The Implication

The research validates our intuition. The knowledge, networks, and judgement we’ve been building over the past decade are valuable, portable within our industries, and increasingly difficult for others to replicate.

Or in cases where our consulting experience has made us work across industries so far, now is the time to start going deep on one industry. We’ve seen enough breadth and now need depth that could compound quickly and put us on a potential pathway to senior leadership.

The wage premium for this industry-specific capital will continue growing as we move deeper into mid-career, making the commitment increasingly worthwhile both financially and in terms of career advancement opportunities.