If you’ve been waiting for an update on my most important business and economic news of December, it is finally here. The holidays delayed its publication until now.

Analysis by the Centre for Policy Studies (CPS) puts the UK housing gap at 6.5 million homes. This conclusion is partly inferred from the following observation: “Britain has just 446 homes per 1,000 people, the second-worst rate in Europe. This compares with 560 in France, 516 in Germany, and a European average of 542.”

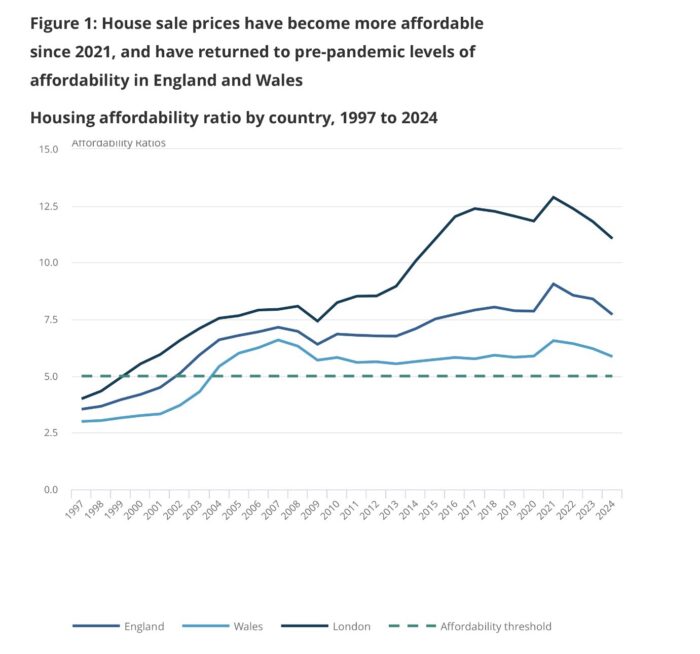

Given such a gap, it is no surprise that housing affordability in the UK, especially in London, has been on a steady decline since the beginning of this century. To close the housing gap by 2040, CPS estimates that “the UK needs to build 565,000 homes per year, more than double the current rate.”

Several factors are responsible for this supply crunch, and supply is a reasonable area of focus. Rising demand is not the issue. Why would one want to suppress demand, which signals economic opportunity? The supply crunch is due to regulatory issues.

These range from land-use restrictions and administrative delays to environmental mandates. Together, they have crippled the supply side of housing.

In December, however, the government took an important step towards addressing this through a bill called the Planning and Infrastructure Bill. The bill’s aims can be summarised as follows:

- Slashing delays and costs to get homes and critical infrastructure built faster

- Introducing sweeping measures to accelerate reservoir construction and prioritise electricity connections to drive growth, create high-paying jobs, and bolster home-grown clean energy

- Plans to build 1.5 million homes and meet a target of 150 decisions on major infrastructure projects

This represents a major step towards easing this burden. It is a landmark effort that led Propertymarket (via The Intermediary), the UK’s leading professional body for property agents, to call 2025 “one of the most significant year for housing reform across the UK.”

This was the most important piece of news for me, given how critical housing is to everyone and how directly a nation’s prosperity is linked to housing affordability.

I will be watching closely to see what comes of this. Already, as of this morning, the Financial Times has reported a slower rate of increase in UK house prices, 0.6% in 2025 compared with analysts’ expectations of 1.2%. Housing affordability has also returned to pre-pandemic levels, after rising sharply beforehand.