Invest $200 and earn 30% ROI in a year, you will feel two things. One, 30% in the scheme of things is a lot and you may even brag about it. Two, when you realise that a 30% ROI is mere $60, you become unsettled. Unsettled because your target towards financial freedom is $1m.

Continue readingTag: Investing (Page 2 of 4)

Last year was the year a lot of us were first introduced to stock market investing. It was an awesome and advantageous year for those who invested as much as a little of their money.

Continue readingFear, Greed, Hope and Ignorance are the 4 Apocalypse. Of the 4, the first 3 have to do with human emotions and they have together wiped out more wealth in the world of investing than any bear market had done in history.

Continue reading

GameStop! Same Lesson, The Future Is Unpredictable

When an unknown stock out of nowhere makes all the major headlines and takes over FinTwit, you will do well to pay attention to the story of what may be going on.

Continue readingIf you are conversant with this blog you would have learnt that I like simple things. I like my investment process to be as simple as possible, I like writing to be as simple as possible and I like to do things that will allow me to have a night sleep.

Continue readingAre you a polymath? Someone that wants to do a lot of things, you see yourself creating a massive empire in a lot of unrelated areas. You just want to do a lot of things or you are even doing them already. However, you noticed the results aren’t forthcoming, or importantly, you realize that the world wants you to pick one thing from all.

Continue readingTrue riches come from your income source not how you spend your income. And investing is a function of how you spend your income.

Continue readingI was reviewing some data when I realized a lot of people are seriously wondering and interested in the answer to the question of if they should use Rise for their investment or Bamboo and its alternatives (Trove and Chaka).

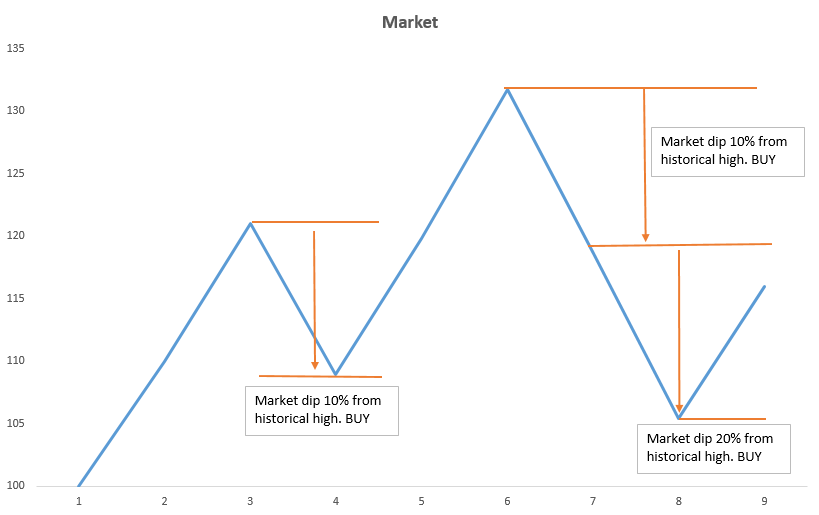

Continue readingI, like many others, have used the word “dollar cost averaging” countless number of times. We use it when asset prices are going up and when they are going down. We treat it as the holy grail for the rational investor. But never has anyone put it in proper perspective as I am going to put it for you in this article.

Continue readingDid you buy the dip? he asked. After waiting for 24 hours and an eventual rally, not a single soul came out to say they bought the dip (price drop). That is how the story always starts and ends.

Continue reading