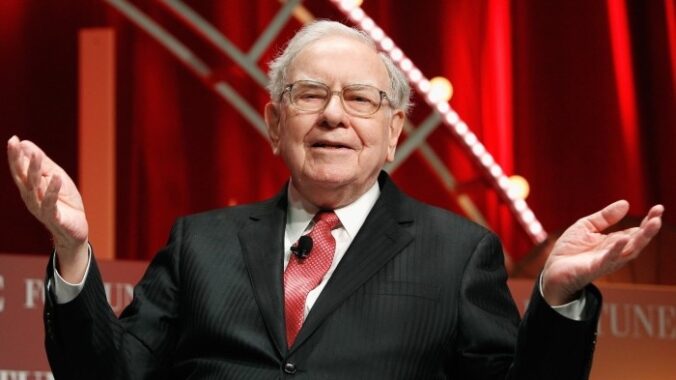

Getting introduced to stock market investing during my undergraduate days was synonymous with getting introduced to Warren Buffett. There was a fanfare about even knowing him in my circle of friends: “You don’t know the Oracle of Omaha?” one would query, rhetorically, in such situations.

Over the years, I’ve read a few of his annual shareholder letters, two books that touch on different topics about him, and countless articles, videos, and audios.

Continue reading