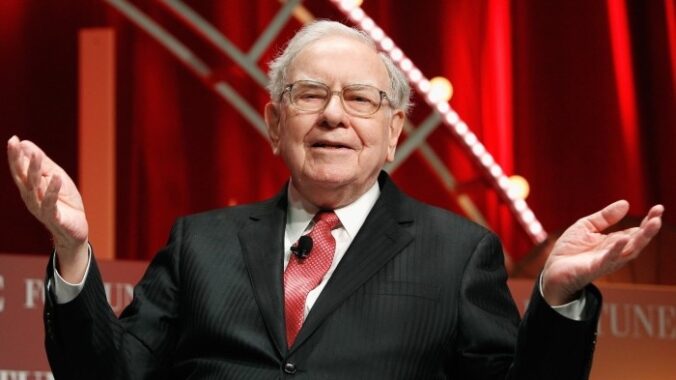

Getting introduced to stock market investing during my undergraduate days was synonymous with getting introduced to Warren Buffett. There was a fanfare about even knowing him in my circle of friends: “You don’t know the Oracle of Omaha?” one would query, rhetorically, in such situations.

Over the years, I’ve read a few of his annual shareholder letters, two books that touch on different topics about him, and countless articles, videos, and audios.

I don’t need to make introductions in this opening paragraph about who he is. Today, 31st December 2025, Buffett will step down from leading Berkshire Hathaway (BH) and go quiet from the public eye as well. He will remain chairman of the company, though. Buffett is 95 years old. He started leading BH in 1965, when he was 35 years old.

In that time, Buffett took the stock from $19 per share to $750,000 per share. That’s up +3,950,000%. In the history of investing, no one has done it in that fashion prior, and probably no one will after him. It’s like the biblical commentary that would say of different individuals, “there was none like him before him, and there would be none like him after him.” – 2 Kings 23:25 (KJV).

Seth A. Klarman, CEO and portfolio manager of the Baupost Group, wrote a tribute to Buffett. It was a good read, and what follows are snippets from the post and my accompanying commentary.

Link to the The Atlantic Article- How Warren Buffett Did It

- Instead, [Buffet’s] brilliance—a low-key, midwestern type of brilliance—found expression in the prosaic art of investing: buying this stock and avoiding that one. Buffett himself has called this task “simple, but not easy.”

- Investing, in my view, is simple, as Buffett mentioned. But is it easy? Absolutely not. On how easy it is, I have written much on that topic before: What Goes Behind Your Buy/Sell Mandates and How to Start Investing are two good ones. The easy part is what is so confounding to me, even today, that I am still learning about it. I think a big part of the reason why it is not easy is due to psychological contradictions—where investors misinterpret signals due to bias, and loss aversion leads to holding losers and selling winners at the wrong times, among others. I also wrote about this in The Four Horsemen Apocalypse of the Stock Market.

- These qualities—relentless curiosity, analytical consistency, focused effort, and humility, along with high integrity, a personality unchanged by wealth or success, and a sunny optimism about the United States—have made him an American role model.

- There’s no doubt that Buffett stands up there as a role model to many. For me, it started with that first equivalence of investing with Buffett. Much later, I read books like How to Interpret Financial Statements Like Warren Buffett in an attempt to be able to think as he thinks.

- [Buffet] made his first investment (in Cities Service preferred shares) at age 11.

- That’s quite early. I didn’t know about buying shares until 2009, at age 13, and I didn’t buy my first stock until 2016, at age 20. Later, in 2019, I wrote about my experience in an article.

- Buffett’s personal investment in Berkshire Hathaway ultimately grew to be worth more than $125 billion, even after he had donated many tens of billions’ worth of shares to charity. No one else has ever built such an investment fortune from scratch; it was as if he hit a lottery with an ever-growing payoff, though one based not on luck but on the consistent application of skillful effort.

- Again, we call him the Oracle for a reason. Self-made wealth is something that’s constantly tracked in our capitalist world. But what can be observed is that only Buffett made the top wealthiest list through investing, with $125 billion worth of wealth. Ken Griffin of Citadel comes next, with an estimated net worth of $50 billion—Buffett has given a few billion dollars more ($60 billion) away to charity in his lifetime, leaving $125 billion remaining.

- Definition of a value investor: Value investors are a quirky breed. They tend to be mathematically precocious and interested at an early age in collecting stamps or coins, handicapping racehorses, starting businesses, investing in the stock market, and finding ways to make money. They are consummate bargain hunters and have personalities that make them natural contrarians. They don’t gain comfort from consensus, and even become uncomfortable when their views go mainstream. Although most investors get excited by whispered tips or hot public offerings, value investors aim to remain disciplined and focus on the underlying worth of a business, its return on invested capital, the earnings and cash flow that are being generated, and the company’s future prospects.

- Am I a value investor? I don’t know. Or maybe I don’t think that’s what I do with my investments at the moment. What I prioritise now is the best opportunities available to me. If that means I invest from a value perspective, fine; if not, I’m also more than okay. As long as I continue to compound my capital, I do not have an investment identity yet.

- Over the course of his career, Buffett successfully navigated market booms and busts, financial crises, wars, pandemics, and mind-boggling technological innovations that spawned countless businesses while disrupting, even displacing, a great many others. Through all of this, Buffett simply marched ahead, seemingly unfazed.

- He did it over more than 60 years, with 60 years being the most tracked period. It’s impressive what he has accomplished.

- He was immune to the tendency of most investors to focus on the trendiest sector or the hottest new technology, and over time this served him exceedingly well.

- It did—he amassed unprecedented wealth as a result. But it’s also worth mentioning that he later wished he had invested in “trendy” Google, not because it was trendy, but because it fit his value strategy, even though he had avoided it for being trendy.

- Buffett has often noted that he benefited from serendipity over his career, and in some ways he did. In his own lexicon, he was a winner of the “ovarian lottery,” born in good health and with a fine brain into a two-parent family that was reasonably prosperous.

- There have been many whom the media have labeled the “Warren Buffett of XYZ” over the years, and some who have labeled themselves. But no one has been able to replicate what he has done. There are many reasons for this, and I believe luck—Buffett has acknowledged it—is at the top of that list.

- …he refined his approach to focus less on lower-quality companies trading at bottom-of-the-barrel valuations and more on the quality of the underlying businesses, even when that meant paying up, because the higher quality would likely lead to a growing and more valuable investment. Buffett acknowledged his new insight this way: “I try to invest in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.”

- I recently attended a stock pitch competition at London Business School, and an overwhelming majority of stocks were pitched because of a perceived mid pricing, with the stocks stated as underweight. I obviously disagree. I don’t believe the market is efficient, but I also do not believe the market is dumb. I could say this was a reason why it made sense for Buffett to rethink the transitional definition of value in the way he eventually did: it is fine to pay a premium for a high-quality business.

- Within the academy, Buffett came to be seen as one of a kind, an n of one. But rather than study Buffett and what he did, for decades finance professors clung to their theories and invented new ways to explain away his success. Even today, finance students continue to be taught the efficient-market hypothesis.

- This is an interesting one because I will be in class this spring studying investment, and the efficient market hypothesis is a topic we will have to touch on. I think the efficient market hypothesis is useful in an academic context because, in academia, explainability is key, and without assuming an efficient market, it’s hard to explain market dynamics. I will learn whatever the academic has to teach, but with full awareness of the limitations of that. Alpha exists in the market—that much I’m certain of.

- Buffett has often noted that the greater the number of people who are taught that the markets are efficient, and that fundamental investment analysis is a waste of time, the more subdued the competition and the better it is to be a value investor.

- Haha. If we take his word for it, one can be sure to find the alpha they seek. If they can painstakingly search for it..

- The respect for him in the business and investment communities (including among individual investors) was so widespread that ideas gained import simply because he had articulated or supported them.

- On this, buffet once said: ”I was the same person when I was 25 that I am now. I had the same ideas. But nobody wanted to listen to me then, and now they do—simply because I’ve made a lot of money.”

- Buffett’s accumulation of enormous wealth hasn’t changed him, something that most enormously wealthy people can’t claim. Throughout his working life, he remained fundamentally the same person he had been when he was a child: bright, curious, and upbeat.

- One of the appealing qualities in the Oracle.

- The world of investing will be different without Warren Buffett at the helm of Berkshire.

- Indeed, it would be different. I never got to attend the shareholders’ meeting in Omaha and never met Buffett—not even close. Yet his influence reached my corner of the world. He will be greatly missed.

- New generations of investors will come along, including some shooting stars who will flame out and others who will endure. But judged over the fullness of a career and by the complete record of his accomplishments and the values underlying them, Warren Buffett has truly been, and will remain, one of a kind.

- We may never see anyone do it like Buffett did again. That’s humbling and makes him even more legendary.