How To Start Investing

The question I get at almost every passing week on Twitter is “David, I’m new to this stock investing thing, could you please tell me where to start and what stock to buy”? I have tried to answer as many people as I can, but I believe it’s time I answer this question more extensively for everyone.

The world did not start knowing prosperity until the 1800s that marked the beginning of the industrial revolution. It was the age when we moved away from scientific invention to innovation. From then on till today, the growth never slowed down again. We basically accelerated.

The industrial revolution ended and the information age even did more to growth in the shortest period of time. Much faster than the rate at which the industrial revolution did. The industrial revolution used 150 years to move the average global GDP per capita from $2,000 to $10,000. While the information age that started in the 1950s has moved that $10,000 to about $40,000 for the most advanced countries where these were all pioneered.

The United States of America was the epicentre of this growth. The United States under titans like John Rockefeller, Andrew Carnegie and Elon Musk, Jeff Bezos, for our generation pioneered the finest businesses of this era. They built companies that grew in value and the American population participated in prosperity share via investment in the stock market. They made a fortune from this market just as the builders made. There is a popular story of Grace Grooner recounted by Morgan Housel. She died a millionaire despite being a secretary throughout her professional life.

It is absolutely understandable for us outside of the United States to desire to benefit from this opportunity.

However, up until now, this prosperity has only been enjoyed by Americans alone who invested their savings in the stock market and watched its value grow tremendously and even predictably. While other countries also have their stock market, not one of them has delivered the kind of prosperity that the US stock market has delivered since it was founded in 1792. Hence, we’ve been left out.

I am fond of saying my generation has an unequal advantage to build wealth that any generation before us did not have. I still stand by those words and this sentiment applies to all countries where once the ability to invest in the US stock market wasn’t available but now is.

With this knowledge, how can you invest to benefit from the massive opportunity?

Our basic instinct to the stock market

The basic instinct of anyone when first introduced to the stock market is to see it as a place where they can put a buck and quickly make some gains. After which I like to ask them what next? What if the company’s stock is still going up? Would you buy again to make another buck or will stay away from the company entirely.

Usually, I see that as an unnecessary mental dilemma.

Let me go straight to the point to say that you may stop reading this post of what you hope for is some strategy on how to do something like that. To buy and sell and find the next to buy which is basically trading. This article isn’t for you. It is rather for those who plan to utilize this opportunity to build long term wealth.

The first question every individual who is getting involved in the stock market has to answer is the question of why they are there. Why have you come to the stock market, to invest or to trade? No one is more honourable than the other by the way. However, if you do not decide ahead of time why you have come to the stock market, you’d be playing the fools game.

I like the words of Benjamin Graham on this point.

“There is intelligent speculation as there is intelligent investing. But there are many ways in which speculation may be unintelligent. Of these, the foremost are:

- Speculating when you think you are investing.

- Speculating seriously instead of as a pastime, when you lack proper knowledge and skill for it; and

- Risking more money in speculation than you can afford to lose.”

So it is important to determine in advance Which table you are on. Else, you would be doing unintelligent investing in general.

I assume you are here to learn about investing and not speculation.

Two investment parts

There are two broad ways to participate in the stock market. Once you invest in a basket of stocks already selected using metric. And two, you pick the individual stock yourself.

Again, none is more honourable than the other once you know what you are doing.

However, over time, we have learned that the idea of picking stocks is not something everyone can do. The sheer amount of what it requires to know how to, plus the probability of any individual consistently outperforming the broad basket of stocks approach has proven that at best no one should go this route except they are willing to do the work that needs to be done.

I must mention at this point that this has nothing to do with your level of intelligence as much as it has to to do with how the market itself works. In 2007, Warren Buffet placed a bet together with a hedge fund manager (one of the most sophisticated types of investors) that over a period of 10 years, they wouldn’t outperform the S&P 500 net of fees. By the time the bet matured in 2019, it was so that they didn’t outperform the “basket of stocks”. So even the most knowledgeable could underperform what they were usually employed to outperform. So it’s not just about you when I say you may not outperform the “basket of stocks” option.

It is in light of this that my usual investment advice for anyone including me is to go for the “basket of stocks” option.

The basket of stocks is called an ETF for our sake. An ETF can either be passive or active.

Passive ETF

Passive ETFs track an index. For example, SPY is an ETF that tracks the S&P 500. S&P 500 represents the top 500 companies listed in the US. There is a standard requirement for companies to be added and removed from the index. That’s something you don’t need to bother about. Passive means no one is buying and selling stocks in the ETF every other day. The only time things change in the basket is when the condition to add or remove a company’s stock from the index is triggered. I’m glad we witnessed that lately with the addition of Tesla.

The characteristics of ETFs like this is that they are always low cost. That is, their expense ratio, which is the cost of managing the basket is always lower compared to the actively managed. They range from 0.01% to 0.1%.

Join 300+ people who are subscribed to my newsletter via this link to get notified of future posts like this and more.

Active ETFs

Active ETFs on the other hand is being actively managed as the name implies. Okay, that’s like a tautology. What it simply means is that there’s usually a manager behind the wheel who on a daily basis decides whether to add stock in the basket or remove from it.

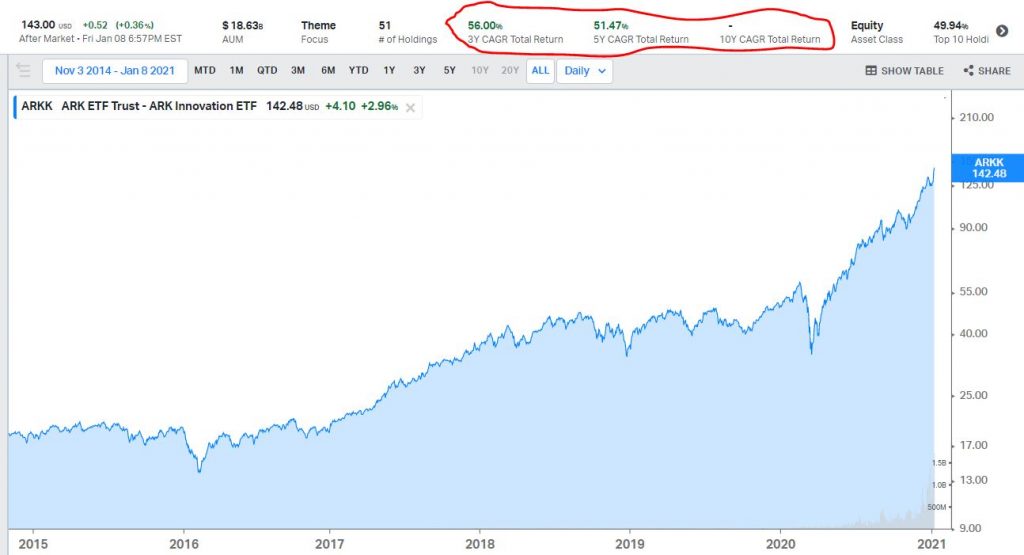

ARKK is an example of such an ETF. Usually, they always have a theme and the theme determines what kind of stock is added in the basket. The theme of ARKK is innovation, so stocks that are highly risky but innovative are what gets added in the basket. There might be another that tracks Cryptocurrency assets or Oil assets or Fintechs and so on.

As you would’ve guessed, the implication of active management is a higher expense ratio. It usually ranges from 0.3% – 2% if not more. ARRK here, for instance, has an expense ratio of 0.75%.

Expense ratio matters. See this.

The most important thing about investing in an ETF is that it takes away from you the burden or task of having to research an individual stock. Which would also require that you often have to check if your assumption for buying them still holds especially in times of massive sell-offs. Of course, the cost of that is the expense ratio you will be charged which is fair.

You will notice that so far, all I’ve been doing is put you in the right frame of mind and arm you with the necessary knowledge. That’s the way it should be. Knowledge of the market you want to start getting involved in is critical. I won’t also be talking about stock picking as I don’t encourage it. And not even when you are new. Also, because what the majority of us can do and do successfully is this type of investment. Stock picking is another game.

What’s the next step?

ETFs You Can Buy and Sleep

What would constitute for you an acceptable average return per year? Often, it is said that 10% ROI on your investment per year for 10 or more years is a good deal. In fact, some may say that’s as good as it can ever get. I don’t contend with that and I would also rather have that than have anything less.

These ETFs have historically given that minimum returns or even more. Take a look at them and decide for yourself which one you want to invest in. Ordinarily, one or two is usually enough. Once you have decided, all you have to do going forward is to buy some amount monthly that you can afford to invest for the long term.

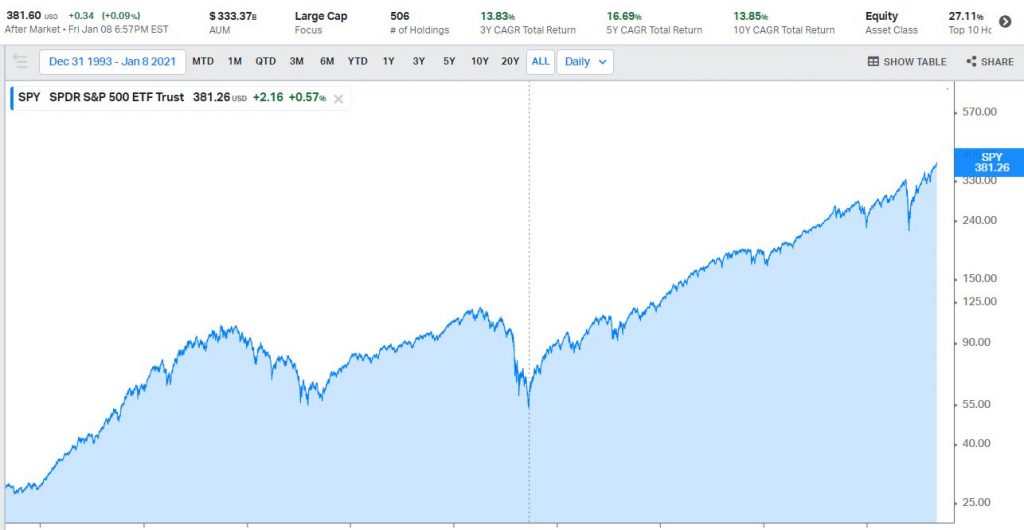

SPY – this ETF tracks S&P 500 an index that contains top 500 companies in the US. This is the index that is usually used as the benchmark for all returns. It is usually the case that if you can’t outperform this, you are better of putting all your money in it. As you can see, over the last 10 years, it has a cumulative average growth rate of 13.85%*. A massive one if you ask me. You will also notice it beats my 10% base rate. Check it out here – SPY for more detailed information.

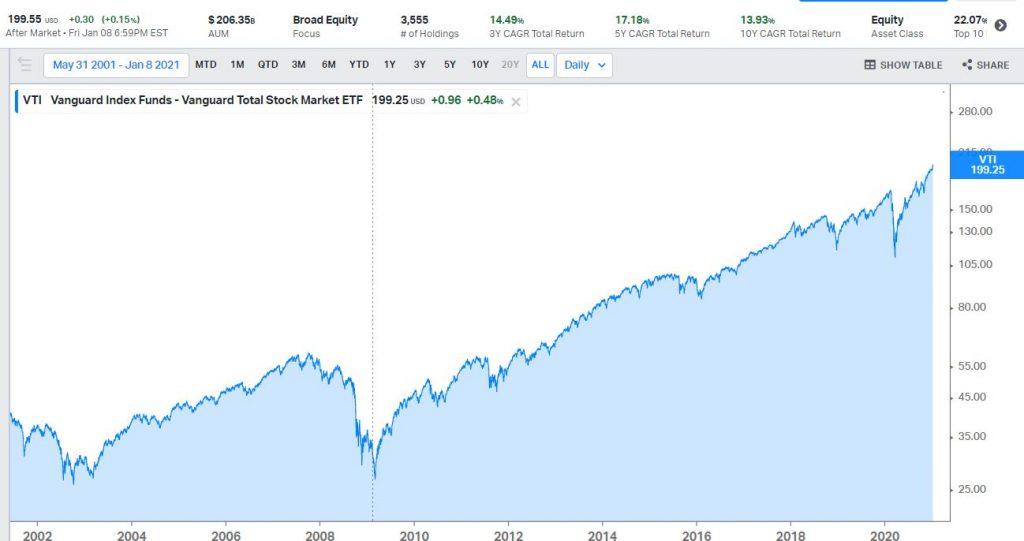

VTI – is an ETF that invests in all the actively trading stock in the US. It’s a total market cap fund. All good and all bad companies are in it. However, because the goods tend to do better enough to cover for the bad, it also has a cumulative average growth rate of 13.93%* in the past 10 years. Anyone invested in it is definitely better off. Probably what you should note is that these returns are despite the quite obvious massive deep of 2008. More on VTI here.

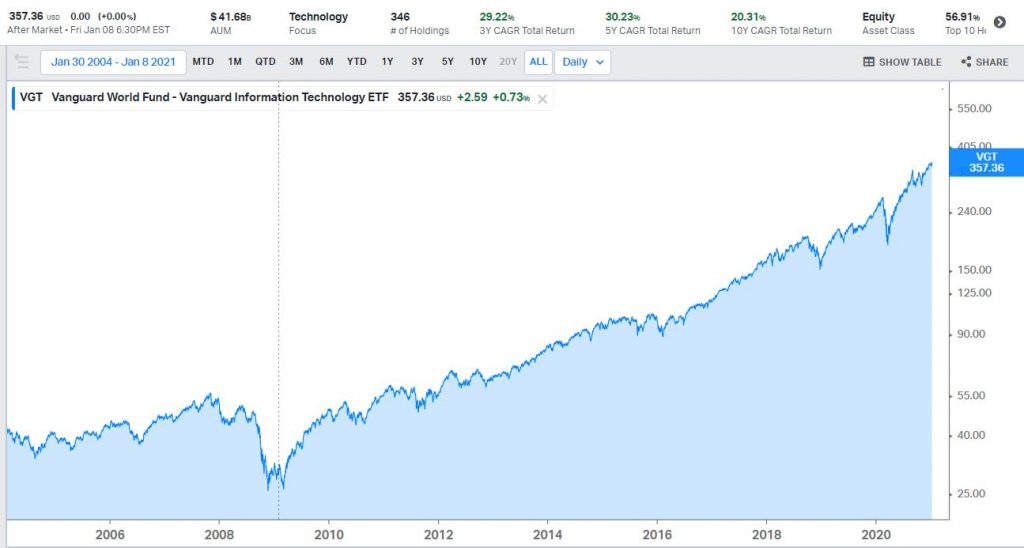

VGT – tracks the top 100 technology companies listed in the US. Companies at the forefront of innovation. Its cumulative average growth rate over the last 10 years 20.31%. This is a matter of getting 20.31%* average return on your investment for doing practically no work. Why would anyone want to take on any additional risk if you can just do the simplest thing and make this much return? I guess it’s the urge in us to make quick money. More on VGT

QQQ – like VGT also invest in top 100 technology companies listed in the US. The only difference is who manages them. And as you can see, it has a similar cumulative average growth rate with VGT at 20.25%*. Click here for more.

ARKK – ARKK is unique on this list as it is the only actively managed fund. Its goal is to invest in disruptive innovative companies. If you do not have 5-10 years investment horizon, you may not want to invest in this ETF. However, over the last 5 years, this ETF has a cumulative average growth rate of 51.47%*. That’s an impressive result at best.

Check out etf.com for more ETFs that are trading on the market. And if you are using Bamboo or Trove, you can easily see listed ETFs on the “featured themes” on the homepage from Bamboo and under the ETFs category from “All Assets” in Trove.

Please use the comment section to drop all your questions. I promise to answer them all.

Let’s build this wealth together and benefit from a generational opportunity.

Join 300+ people who are subscribed to my newsletter via this link to get notified of future posts like this and more.

Also read this – How To Deal With FOMO

Red Alert* – past performance does not in any way guarantee future performance. Also, this does not in any way constitute investment advice. All I’ve written so far are for educational purposes only.

I’ve been browsing online more than three hours nowadays, yet I by no means

found any interesting article like yours. It’s lovely value enough for

me. Personally, if all webmasters and blloggers made

just right content as you probably did, thhe net can be a lot more useful than eve before.

https://www.montessoriathomeuk.com/2020/08/jelly-play-activity-for-toddlers.html?showComment=1611302594363

Listed here you’ll obtain the top notch British isles

essays done accordung to your guidelines.

academi essays

academic essays http://www.carleemcdot.com/2017/10/the-sunshine-blogger-award.html

A very amazing article, thank you.

Glad you enjoyed it.

Thanks a lot for this. Really insightful. My question is not so related with stock investments. I stumbled on Bamboo a few weeks back and I’ve had an amazing experience with the app. Do you know of any similar app for crypto exchange? Most of the ones with good reviews have restricted purchase of coins in Nigeria.

Hello Wahab, I’m glad you found the article helpful.

On your question, I think a lot of people use Binance, Luno, BuyCoins, Bundle and a whole lot of them. Check those out.

Guess this is the only time I have been patient enough to go through stuff like this. This is so bcos when I read a couple of paragraphs, I am lost…. Lols.

Your presentation is as easy as it can get to the layman like me.

This certainly has my interest now, I will subscribe to your newsletter, follow up, and definitely do the needful.

Best wishes Bro.

I really appreciate your feedback and I’m glad you found the article useful.

Please remember to share with your friends as well. Cheers.