Why I And Others Are Bullish About Cryptocurrency

Cryptocurrency is nascent and hot at the moment. I expect the hotness to continue for another 10 years at the minimum.

Within these 10 years, great wealth will be made by those who understand the trend and play along or those who just got lucky. That’s one part of the story of the next 10 years.

The other part of the story that is most beckoning to me is what would need to happen to enable people to make wealth.

What’s happening with cryptocurrency economically is not new. Right from the foundation of the earth, every technological breakthrough has always created more wealth. Because such breakthroughs either usher in a new economic reality or optimize existing reality.

Either way, what happens is a reduction in friction in how we coordinate as a people. And unavoidably the wealth pie gets expanded.

I read a fascinating account of how the development of maps helped Britain to win battles, conquer nations, and expanded its territory. All on the shoulder of a simple science of navigation.

But hey, you don’t need to go as far back as the 15th century to know this. Just take a moment to contemplate how much wealth the mobile phone in your hand has created in the world and you will start to understand how wealth is inevitable over the next decade.

However, it’s not bad for us to travel as far back as necessary in history to drive home a point.

Life in a state of nature as described by Thomas Hobbs was brutish, nasty, short, and poor. In such a state, humans existed in a small cluster of few recognizable families and an outsider is often seen as an enemy. Also, those small families cultivated “everything” that they needed for survival.

As our population grew, it became glaring that such a state is unsustainable. And we started to coordinate together in larger communities. The first mode of economic cooperation that we could think of was to exchange goods for goods (the barter system). Soon enough, the inefficiency of that system became obvious as well. And we sort a more sustainable way to coordinate.

Our search led us to the discovery of different forms of technology; a way to preserve our goods, a way to protect our territory, a way to better exchange economic values and most importantly a way to ensure our survival.

In all of our searches and discoveries, a common denominator is that we are always moving towards a more efficient and sustainable life. Efficient and sustainable could mean cheaper, faster, better, timely and so on.

That’s the lesson of history.

The question is why do some of us believe Crypto is the next phase of this endless iteration of efficiency and sustainability? It’s simple and may not be so simple as well.

The answer lies at the bottom of the promise of blockchain technology. But it can be obviously found on the promise page of each crypto asset built on it.

Bitcoin is poised to create more wealth

First, Bitcoin. It promises a better way to exchange economic value, accumulate wealth and preserve wealth.

The first question to ask is, is there anything wrong with the way we are doing those things at the moment? The answer is simply yes, there’s something wrong with it. So what’s it?

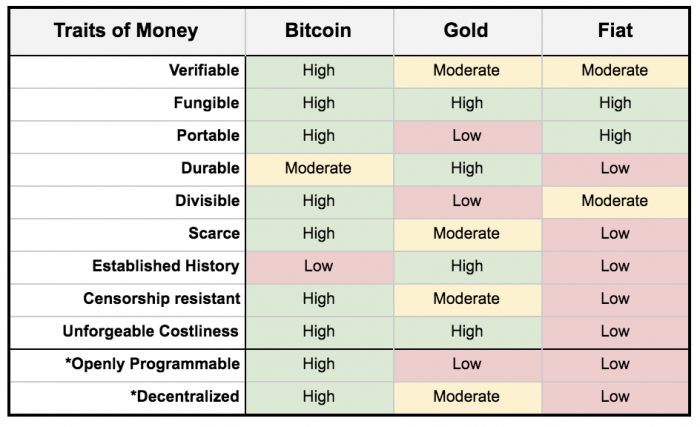

After a lot of iteration, we settled on government-issued money as the best way to coordinate economically. The choice of government money came in after considering some factors (durability, portability, divisibility, uniformity, scarcity and acceptability).

While I can’t dig deep here into each of these factors, I must say that the choice of how we organize economically must put them all into consideration before we arrive at a solution. Yet, history has taught us that of all the factors, there’s one that can’t be sacrificed and that is SCARCITY.

From the times of batter until now, we’ve had to give up a factor in favour of another so that we can organize economically. But not once in that long history have we settled on sacrificing scarcity among the factors. That’s because it’s the most important factor.

Now, agreeing to organize economically under the arrangement of government-issued money was on a condition of controlled scarcity (you can call it inflation at this point). Inflation is simply a measure of how much more scarce or less scarce this instrument of economic coordination has become.

If it becomes less scarce, it means those that hold it becomes poorer (their wealth declines) and if it becomes more scarce, those who hold it become wealthier.

In recent years, for an oftentimes understandable reason, it has become less scarce. That’s the phenomenon of rising inflation and the continued printing of money that we’ve been talking about. And the way it’s trending, there’s no stop in sight and it’s a downward sloppy trend.

That’s what Bitcoin aims to fix. By imposing the most important factor, SCARCITY (21 million units), under a predetermined “less and more scare (halving)” policy (monetary).

The expectation as with every other breakthrough technology is that as the world adopts it, global wealth will increase and those who were early adopters (believers) will be some of those who benefited the most from the wealth.

By the way, new technology brings in more wealth simply because it expands the scope of commerce through the creation of new lines of commerce or increased efficiency in the existing lines of commerce. Bitcoin in this case makes cross border payment more seamless than fiat.

Money exists before and so what Bitcoin is doing is increasing efficiency and sustainability. The easiest to understand use case here is how a lot of people have used Bitcoin to seamlessly facilitate cross border payment. For institutions, they are big on the store of value use case.

The world supercomputer is also creating more wealth

The promise of Ethereum on the other hand is not as straightforward and a bit complicated.

But here’s it: it promises to be the world’s supercomputer. Now, trust me that’s vague and even I still struggle a lot to understand what it means by “world’s supercomputer”. Yet, we are also bullish on it because it promises a more efficient and sustainable paradigm. And as with any technology that promises such, they always create a wealthier future if they achieve their aim. So let’s break the Ethereum promise down a bit more from the vague Supercomputer.

Decentralized Finance (Defi) Non-Fungible Tokens (NFTs), and Decentralized Autonomous Organizations (DAOs). Three of the most popular use cases that Ethereum has enabled on our quest for a better, more efficient and sustainable society.

Just as I explained under Bitcoin, the first question is what’s wrong with the existing system as in the case of Defi and DAOs. Simply put, while the existing systems have been working so far, the believers behind these use cases believe that it can be better. And they have shown this with on-chain data (incorruptible data).

In the case of NFTs, it is the creation of a new paradigm. It is creating a way to originally own digital assets just as you can own physical assets. Before NFTs, infinite replicability makes it hard to know an original digital property and who owns the original. So largely, no one even cares to. But that is fast-changing and in the first half of 2021 alone, NFT has generated a direct sale of up to $2.5 billion.

To bring this to an end, I and others who are keeping a close tab on crypto innovation see these and more and that’s why we are extremely optimistic about the future and the resultant wealth creation that would happen.

Seriously, I have no doubt.

Invest. Bet on the future with me. Build wealth.