In my application essay for my Masters in Finance programme, I wrote that a major reason for applying was to explore the questions of “what to do next” and “where to do it.” In my mind, there were two options:

Continue readingCategory: Articles (Page 1 of 15)

When I started my career at PwC, one of the core messages I took away from the orientation month was that “your career is in your hands.” I also understood that consultancies are highly competitive environments where you can do incredible work with intelligent people and, more importantly, where grit, energy and creativity are well rewarded.

Continue readingOver the years in my career, I’ve watched people sacrifice things I wouldn’t. I’ve also sacrificed things that, to others, made little sense to give up. I’m at peace with those choices — more than that, they are the source of the deepest satisfaction I take from my career.

Continue readingMarcus Aurelius, often described as the last good emperor of Rome, wrote a striking reflection on human work:

Continue reading“At dawn, when you have trouble getting out of bed, tell yourself: I have to go to work—as a human being. What do I have to complain of, if I’m going to do what I was born for—the things I was brought into the world to do? Or is this what I was created for? To huddle under the blankets and stay warm?

So you were born to feel ‘nice’? Instead of doing things and experiencing them?

Don’t you see the plants, the birds, the ants and spiders and bees going about their individual tasks, putting the world in order, as best they can?

And you’re not willing to do your job as a human being? Why aren’t you running to do what your nature demands? You don’t love yourself enough. Or you’d love your nature too, and what it demands of you.”

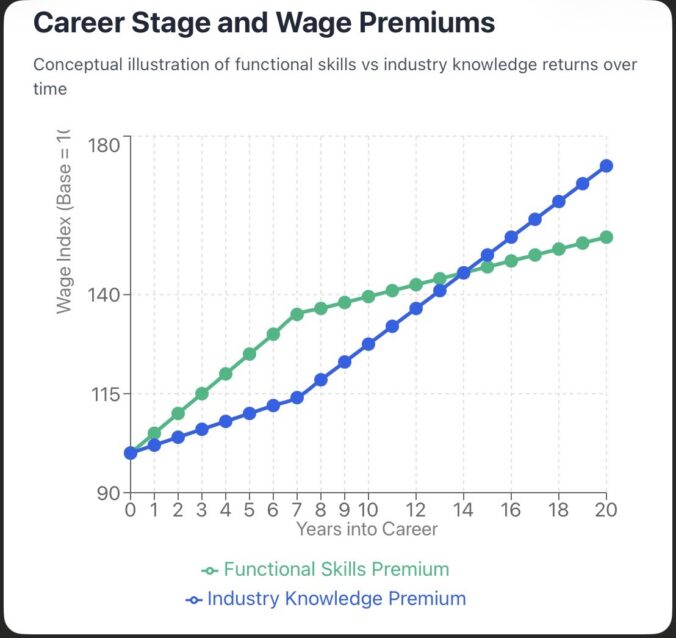

My friends and I, all with nearly a decade of work experience, have been discussing whether to deepen our commitment to a specific industry (even while doing different roles) or to maintain flexibility by moving across industries (even while doing the same type of work).

Most of us started our careers in consulting, which gave us early exposure to more than one industry. We are now thinking about which levers matter most for accelerating our careers over the next decade and beyond.

Continue readingAbout two years ago, I applied for a job at JP Morgan that I’d found on LinkedIn. I didn’t fit the profile for the role perfectly, but it was good enough that I was invited for the first recruiter call and then to the next interview. It was at this interview that the hiring manager and I concluded that I probably wasn’t well suited for the role.

A few weeks later, I was contacted for another interview at JP Morgan, but this time for a role I hadn’t applied to. I showed up, obviously. The hiring manager informed me that I’d been recommended for the role by the previous hiring manager, who thought I might fit their team better. Unfortunately, this role didn’t work out either.

Continue reading“Whoever has will be given more, and they will have an abundance. Whoever does not have, even what they have will be taken from them.” — Matthew 13:12

Early in my career, before I knew it had been popularised as The Matthew Effect, I noticed this phenomenon. I captured it in an article as “it’s much easier to get ‘another success’ once you get the first one.”

Continue readingGetting introduced to stock market investing during my undergraduate days was synonymous with getting introduced to Warren Buffett. There was a fanfare about even knowing him in my circle of friends: “You don’t know the Oracle of Omaha?” one would query, rhetorically, in such situations.

Over the years, I’ve read a few of his annual shareholder letters, two books that touch on different topics about him, and countless articles, videos, and audios.

Continue readingWhen it comes to setting goals for the year, my approach has two parts.

1. The engine that powers all. These are habits and actions that I hold consistent from year to year. They are goals that don’t change (or slowly change), irrespective of what time of the year it is.

An example habit is my waking-up time (between 5:30am and 6am). An example action is my writing (I carry it year over year no matter what). Hold this thought for now.

June 2025, in Round 5 of 6 application rounds at London Business School, I was offered admission into the prestigious Masters in Finance (MiF) program.

August 2025, I started the program. It will take me two years to complete as I am studying part-time.

Continue reading